So this is kind of interesting. Bloggers, photographers, Facebook business page owners and anyone who earns even a couple of dollars from the interwebs, you might want to pay attention to this.

Up-front disclosure – this is not tax advice. Also, as you may know, despite having failed income tax returns in high school (true story), I have a greater-than-average understanding of the peccadilloes of the Canadian tax system. However, this is just my personal observation about a change to a tax form that I have to fill out every year.

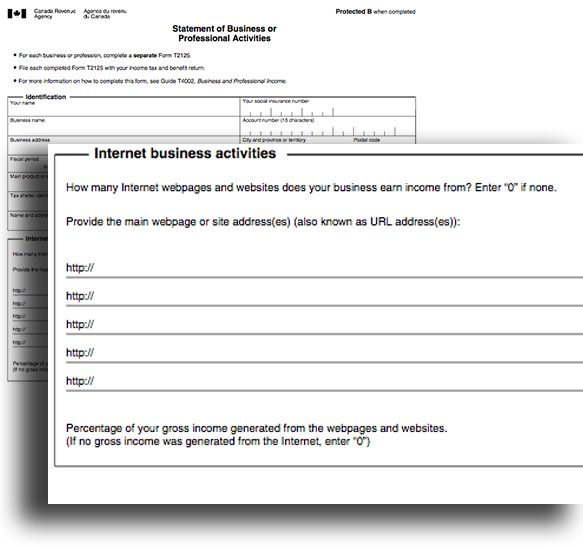

Ahem, so as I was saying… this is kind of interesting. I noticed on the CRA’s form T2125 – Statement of Business and Professional Activities that there’s a extra page this year where you are asked “how many Internet webpages and websites does your business earn income from?†(Let’s put aside for a minute the question of your webpages and websites that aren’t on the Intenet, okay? *shrug*)

Did you know that your web earnings are considered taxable income and that you should be declaring them on your income tax return? You don’t have to be incorporated or register for a business number to be considered a business, but you have to fill out one of these forms and include it with your personal income tax return if you’re earning any sort of income online. Here’s some of the ways you could be earning income from the Internet and should therefore be completing this form:

– you sell stuff directly or through an agent, on a site like Etsy or Photoshelter or iStock.

– you book appointments via a contact form or post your phone number to make appointments.

– you buy and sell stuff on an auction site like eBay.

– you earn income through ads, clickthroughs, sponsored posts, affiliate links, etc.

– you receive income or goods or services in exchange for promoting them on Twitter, Facebook, Pinterest, your website, or any other website.

So what counts as income? These are obvious: sponsored posts, blog ads, affiliate links, pay-per-click links and paid text links. But it also includes all those promotional things you got, from the cans of soup to the free books to family trip to Disneyworld. If you get stuff of any kind in exchange for blogging, tweeting or otherwise promoting that stuff, you technically need to include the fair market value of that stuff in your business income for the year. And stuff includes services, too, like hair cuts or free admissions to local events.

The fair market value is the price you would have had to pay if you weren’t receiving a deal or freebie in exchange for promoting it. So that conference you attended with the free airfare and hotel? You should include in your income the value of the conference pass, the flight and the hotel. That free family trip to the aquarium exhibit? Count what you would have had to pay if the aquarium didn’t comp your admission. That tablet you received in exchange for reviewing it counts, as does the free app codes you received in exchange for tweeting about them.

In practical terms, this means if you are a blogger who has received any sort of income or product or service or sponsorship, or if you are a hair dresser who books appointments through an online interface, or if you are a cupcake baker with a Facebook business page, or if you are a photographer who sells on Deviant Art, or if you have a Pampered Chef or Smelly Candles business that you promote on your blog (even if you don’t have a shopping cart), or if you sell Easter bonnets on Etsy, you should be reporting that income via this form.

The good news is that you can declare expenses that you incurred against that income. You could write off your domain hosting, for example, and the postage you paid to ship a giveaway prize to the winner. You might be able to claim a portion of your home or mobile internet service. And hey, did you know that if you’re running your blog from home (as opposed to, say, from the Starbucks on the corner) you can declare a portion of some of your utilities and other expenses? The Canada Revenue Agency says

You can deduct expenses for the business use of a work space in your home, as long as you meet one of the following conditions:

• it is your principal place of business; or

• you use the space only to earn your business income, and you use it on a regular and ongoing basis to meet your clients, customers, or patients.

You can deduct part of your maintenance costs such as heat, home insurance, electricity, and cleaning materials. You can also deduct part of your property taxes, mortgage interest, and CCA. To calculate the part you can deduct, use a reasonable basis such as the area of the work space divided by the total area of your home.

Please allow me to remind you that I am not an accountant or a tax professional, and this is complicated stuff. If you earn significant income from the web, it would probably be prudent to hire a professional to walk you through the minefield the first time you try to figure out all this stuff. Painful as it may seem, it’s better to get out ahead of this stuff than try to figure it all out after the fact when you’re facing an audit. The good news is, you can claim the cost of the accountant as an expense against your income. Or maybe you could barter blog promotion with a local accountant in exchange for tax help?

Just don’t forget to declare THAT, too! 😉

Additional disclosure just in case you missed the first one: This is not a sponsored post. It was written from my personal perspective and does not reflect the opinions of my employer, the Government of Canada or any tax professional, nor should it be considered a comprehensive examination of the subject. YMMV.

Hey all! Dani, Great post, very thorough. A few adjustments – you can claim 100% of your cell phone and home internet as you can’t do your biz without it.

Great post Dani!

This is very helpful advice!

I shall tuck it away until my dreams begin to develop. 😀

Thank you!

Happy Taxes!